According to a recent study by the Federal Reserve, 69% and 75% of consumer payers and consumer payees, respectively, prefer real-time or one-hour payment speed. This is one of the reasons why the financial industry has been working round-the-clock to make fund’s transfers simpler, more efficient, and faster.

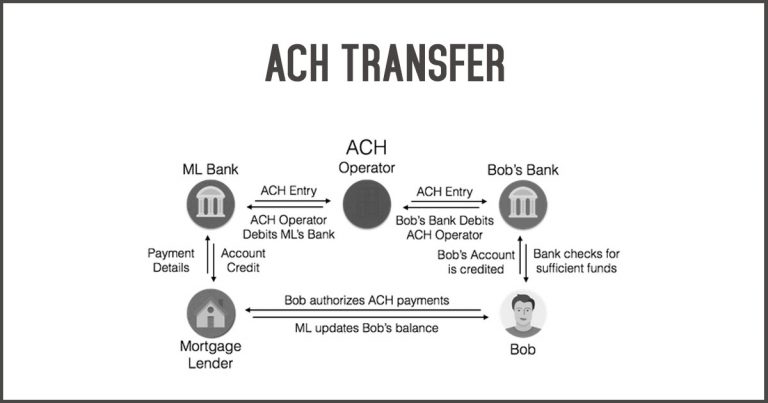

The Automated Clearing House (ACH) network is at the heart of these efforts as it’s the backbone for electronic payments in the country. These include debit and credit-card transactions, bank to bank transfers, ATM transactions, online lending, etc. By speeding up ACH transactions the needs of the financial industry will be met better.

That’s where money-transfer applications like Zelle come in. Wondering what these applications are? By the time you’re done reading this piece, you’ll have known that as well as how they are bound to increase the speed of ACH transfers.

What’s The Current Speed of ACH Transfers?

There are numerous uses of ACH transactions for which consumers and businesses could benefit from the instant processing of funds. However, the standard speeds of ACH transfers do not effectively meet the needs of businesses and consumers when it comes to processing financial transactions.

According to the National Clearing House Association (NACHA), ACH-credit transactions usually settle in 1-2 business days. In case you don’t know, an ACH-credit transaction is that in which you initiate a transfer from your account to a recipient’s account.

On the other hand, ACH-debit transactions normally settle in the next business day. An ACH-debit transaction is the one in which the recipient initiate’s a transfer from your account to their account.

Financial transactions that could immensely benefit from faster ACH payments include:

- Business-to-Business payments – Faster ACH transfers will allow for quicker settlement of invoice payments between business partners

- Account-to-Account Transfers – You will enjoy faster crediting when it comes to moving funds across various accounts you own

- Expedited Bill Payments – With the use of both ACH debits and credits, you will be able to pay your bills on time, which will also deliver faster crediting for late payments

But, why the delay in the various ACH transfers?

Generally, more time between the initiation of an ACH transaction and settlement offers more opportunities to identify and stop fraudulent transactions. It’s worth noting that fraud is a major concern for ACH transactions. You should realize that ACH transactions, particularly debit ACH transfers, can be reversed.

Namely, when you initiate an ACH debit, the sending bank does not know if there are sufficient funds in the paying account. In fact, it has no idea if such an account exists in the first place. Instead, the financial institution that receives an ACH request has the option of rejecting the request for a variety of reasons, which include:

- Customer disputes

- Insufficient funds

Most ACH reversals take place within 24 hours. However, they can occur as much as two months after the initial request. This normally happens if you have a dispute that exposes the originating bank to risk through the entire period.

Despite the risks involved in ACH transfers, players in the financial industry are still pushing for faster payment solutions, which deliver:

- Convenience

- Predictability

- Transparency

- Affordability

Well, as a consumer, you should enjoy a seamless experience when you initiate, track, and receive funds from any platform. That’s what applications such as Zelle promise to deliver. Let’s have a detailed look at that.

How Will Applications Like Zelle Save the Situation?

Money-transfer apps like Zelle promise to transform how you manage your financial life. Namely, they’ll deliver faster, safer, and more convenient person-to-person funds transfers. In the words of Early Warning CEO, Paul Finch:

“We are pleased to partner with the leading financial institutions and financial service organizations in the country to make our vision for faster payments a reality for millions of consumers nationwide.”

Early Warning is the company that owns the consumer-facing Zelle app. With this kind of app, you will be able to send money to virtually everyone. All they will need is a MasterCard- or Visa-branded debit card.

The recipients will receive the money straight away. They could use the money to settle bills or make payments to other individuals. While similar services have been in existence, they are largely limited in their abilities.

For instance, most of the earlier standalone apps operate as a third party. What does this mean?

If your customer initiates a transfer, the money doesn’t proceed straight from his account to your account. This provides a leeway for fraud. An unscrupulous customer can cancel the payment before you cash out.

With applications like Zelle, however, you’ll experience great security and improved efficiency. Take Zelle for instance; it will be integrated into your bank’s system. In so doing, you will be able to receive money directly into your bank account. This ensures fast and secure transfer. Online lending will also not remain the same. It will definitely undergo significant transformation.

Businesses and consumers prefer simpler, convenient, secure, and most importantly, faster money transfer solutions. However, most ACH transfers take at least one day to complete. Fortunately, money-transfer apps like Zelle promise to turn around the financial industry when it comes to funding transfers. Such apps promise to provide safer, more convenient, and incredibly faster payment options.