New data from Jon Peddie Research (JPR) shows that the PC and GPU industry is in a period of change. As a result of multiple disruptions occurring on the other side of the world, everything is starting to slow down. Security measures concerning COVID-19, the conflict in Ukraine, and nations still recuperating from the epidemic are to blame. This has led to a decrease in exports in the near term, however, the prognosis isn’t bleak. Pandemic-induced period of record-setting exports for game components is passed, that much is certain.

The Statistics

GPU-equipped PC shipments fell 6.2% in the third quarter as a whole. This is not unusual, since deliveries routinely go behind schedule in the first quarter by an average of 7%. Consignments fell short of 0.3 percent in Quarter 1 2021, so this represents a “bounce back,” if you will. JPR maintains that the market’s foundations remain sound, notwithstanding the recent slump.

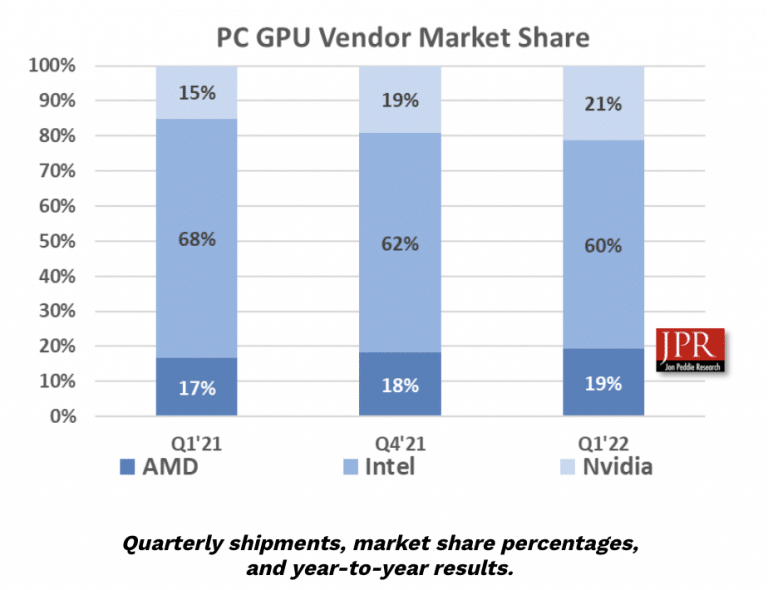

There is a 6.3 percent cumulative annual growth rate for the GPU industry throughout 2026. Just 0.7 percent of the market went to AMD in the last quarter, but that’s still an improvement. Nvidia achieved the same, increasing its share of the cake by 1.69 percent. Intel was the greatest loss, losing 2.4 percent of the industry, but still holding the majority of the business for graphics cards. This market encompasses laptops including CPUs integrated iGPUs, which Intel in this sector has historically dominated. These parameters also increase AMD’s share in the market.

Intel took the burden of the reduction in GPU shipments. AMD only saw a 1.5% drop in shipments, but Nvidia shipped 8.7% fewer GPUs. There was just one rise in exports from Nvidia, a 3.2 percent uptick.

Intel Might Lose The Race

We can observe that AMD and Nvidia are nibbling away at Intel’s customer base in the graph above. Although neither business is stealing large swaths of Intel’s market dominance, it seems to be a gradual decline. In the last year, Nvidia has taken six percent of Intel’s sales volume away. Even yet, Intel’s market share remains at 60 percent, so there’s no need to give it a go.

Aside from that, it will be fascinating to watch how AMD’s Zen 4 affects these figures. Even AMD’s most expensive Zen 4 CPUs will come with an integrated graphics processor (GPU), which is a first for the company. Zen 3’s most capable CPUs did not contain integrated graphics. As a result, when Intel starts delivering standalone GPUs, it would be able to battle for market dominance with AMD and Nvidia for the first time.

Similarly, the Desktop GPU market is through a period of change at the moment. While mobile versions of AMD’s, Nvidia’s, and Intel’s newest architectures were just introduced, each firm’s next-gen competitors are also near to being unveiled. The RTX 4090 is supposed to be Nvidia’s latest Ada Lovelace technology, whereas Zen 4 is now expected to be released in the autumn. RDNA3 GPUs are expected to follow soon after.

Additionally, Intel’s Arc desktop GPUs have not yet been released, however, its Raptor Lake Processors might be released in Q3 as well. It’s as though we’re into a summer slump as we become more excited about what’s still to come. Even though AMD, Intel, and Nvidia (AIN) introduced new products in the second half, buyers remain wary,” Jon Peddie said.