Ethereum serves as a building block for smart contracts, Decentralized finance, as well as NFTs. However, despite its widespread use, the platform is having trouble competing with its rivals. Owing to the mad scramble surrounding various NFTs, and DApps, a fierce rivalry has arisen amongst the protocols at the layer one level.

A new layer one protocol emerged in 2021 promising a fast processing speed and reduced cost for the NFT marketplace. With the Ethereum 2.0 update, Ethereum aims to outdo the competition with both features. Even while both of the blockchains have advocates, Ethereum is the most popular because of its transparent DApps ecosystem. No matter how hard we try, we can’t overlook the stark contrasts between these two competitors.

Even if you’re an NFT novice or an NFT marketplace developer, this article will provide you with an in-depth look at Both Polygon and Ethereum and how they vary.

Let’s begin.

Contents

1. Consensus Mechanism

Ethereum

Different apps are actively utilizing the 1.0 version of Ethereum. The Proof-of-Work mechanism leveraged by Bitcoin is likewise employed by the Blockchain as well.

There are hundreds of blockchain miners actively engaging in the consensus process to ensure that the platform is stable and secure.

The procedure depletes the network’s computing strength, making it difficult for users to engage. As a result, the network remains decentralized as well as safe, but its performance suffers as a result.

Polygon

Polygon makes use of a variety of technologies to build a quick Blockchain and connect it to the core Ethereum network. In order to protect the network, Polygon employs a novel consensus technique called PoS (Proof of Stake). It implies that the only method to generate revenue on MATIC is via staking.

The role of the Validators is to authenticate the transactions and then add them to the Blockchain. Validators earn a snip as well as a fresh MATIC in exchange for their services.

Becoming the validator requires you to operate a node full-time, where you risk losing Matic if an issue arose. Delegators use full-time validators to secure the Matic. Your staked MATIC might be at risk if you commit any error.

2. Fast Transactions

Ethereum

Ethereum relies on a distributed network which means each and every member of the Ethereum network has a shared ledger that is exactly the same as the others.

These ledger holders are in charge of running and managing the network. The amount of transactions that may be processed per second on Ether is restricted.

As a result, there is a big potential for rival blockchains to thrive, as it is very congested and you either have to pony up a high price or stand in line.

Polygon

When it comes to scalability and performance, there is no match for Polygon. It’s capable of handling 65,000 transactions every second. A stat that is yet to be bested.

Polygon Matic is an excellent tool for both developers and end users. Polygon likewise makes it easy to construct Ethereum-based decentralized applications.

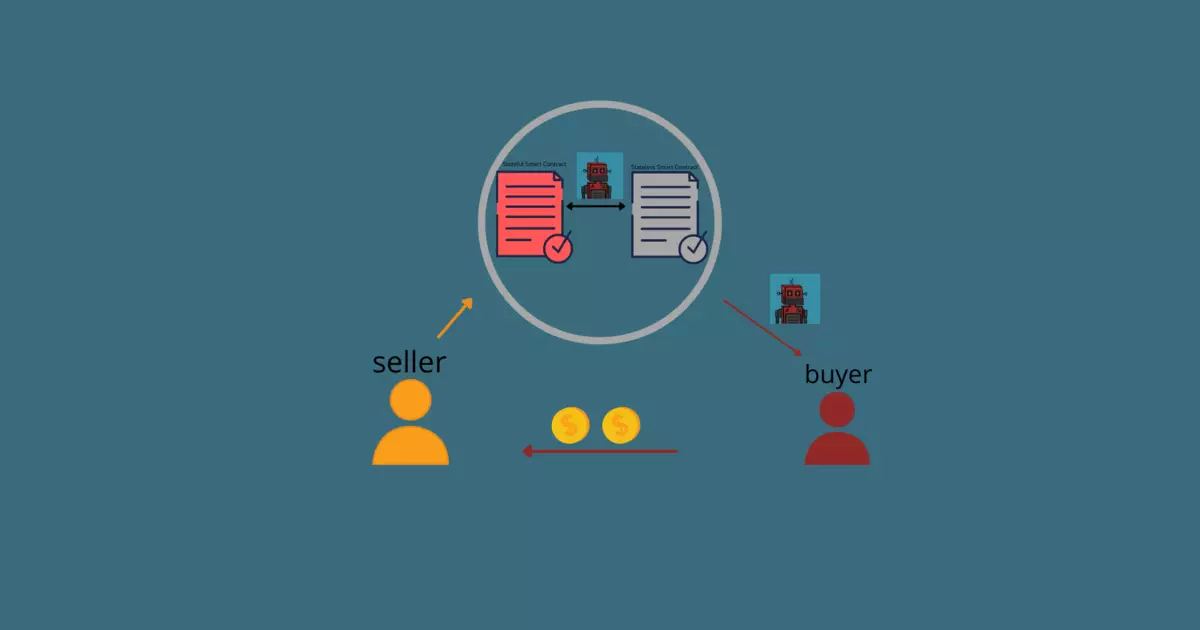

3. Stateful Architecture

Eretheum

Owing to its Stateful Structure Eretheum every transaction is logged in the system’s state. Every time a new transaction takes place, the copy is updated in real-time to reflect the change.

For instance, If William sends $10 to Robert via Ether, then the miners must amend its data to reflect the new design. Since this procedure is expensive, stateless blockchains, such as Bitcoin and Polygon, are regarded to be faster.

Polygon

Polygon provides the essential component and tool for connecting the modern economy and society. As with previous POS blockchains, the sidechain works in the same way. The only exception is that all of the trades take place on the Ethereum main chain. To facilitate transactions, Polygon Blockchain utilizes Matic.

4. High Gas Fees

Polygon

Polygon’s unique selling point is that you don’t have to invest exorbitant gas fees for NFT mining. Running Polygon on OpenSea does not incur any gas fees.

You must, obviously, have to pony up a gas fee in order to acquire an NFT on the Polygon blockchain since NFTs on this network can only be bought with Polygon ETH.

However, if you want to receive Polygon ETH, you’ll have to spend a gas cost to bridge your ETH to Polygon. As a result, Polygon does charge a gas fee, although it’s a little less compared to ETH.

Ethereum

People with little holdings cannot make any swaps because of the high gas costs tied with ETH. A recurring charge or a one-time charge are the two basic types of gas costs. Auction Approval and Initialization Payments are two separate one-time fees. OpenSea levies a one-time initialization payment for selling NFT on Ethereum. This cost is not set in stone, since it is influenced by the existing gas fee.

There is a multitude of recurrent costs on the Ethereum network.

Whenever you join the bidding, transfer or purchase an NFT, withdraw or stop bidding on an NFT, or transform WITH to ETH, you’ll be charged these costs. The costs range from $50 to $200 on average.

The Takeaway

Polygon is an ideal blockchain to start an NFT project associated with low transactional values and high frequency. On the contrary, Ethereum is the premier blockchain to launch low-value transactions and high-frequency NFT projects.

For those that want to put out between 7,000 and 10,000 NFT works, I recommend starting on Polygon. Even though your NFTs are pricey, Ethereum may be a good choice for those who are certain that they will sell out. Polygon, on the other hand, is a good option if you want to save money.

Many major NFT projects leverage ETH because such fees serve as an entry barrier for new and less serious investors. The fact that you must pay a gas price to trade your NFTs also serves as a motivation to keep them. To date, Polygon has demonstrated that reduced fees and faster transaction times can be achieved on the Ethereum network but ETH might catch up since its constantly improving its network.